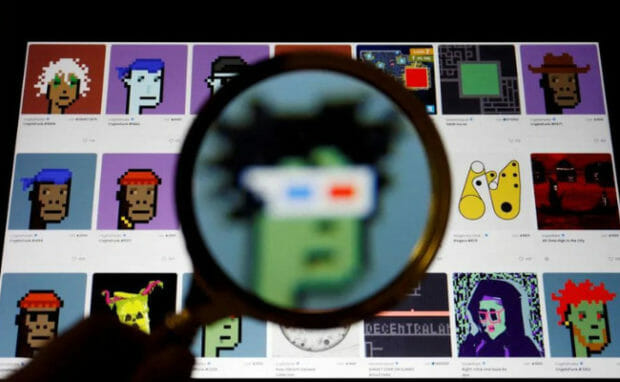

NFT Market Trading Volume Crashes By 97%

Fewer people have been buying and selling non-fungible tokens. As a result, the NFT market experienced a sharp decline in trading volume of 97%.

According to Dune Analytics, the volume crashed from $17 billion in January 2022 to $466 million in September. The former month marked the NFT market’s peak.

Weekly trading volume heightened to an all-time high of $146.3 billion in April 2022. Then, it crashed alongside the beginning of the current crypto bear market.

Other NFT market updates

Photo Credit: www.alioze.com

Ownership of non-fungible tokens rose despite the trading decline. According to CoinTelegraph, the number of crypto wallets containing at least one NFT increased to 6.14 million.

In contrast, that number was 3.36 million at the end of January 2022. Moreover, the marketplaces themselves underwent massive changes.

For example, more people have stopped using OpenSea, formerly one of the most well-known marketplaces. Instead, they went to LooksRare, which now receives most of the dollar trading volume.

Why is the NFT market down?

Photo Credit: www.brookings.edu

We can discuss many reasons why fewer people buy and sell NFTs. The most significant factor is the current crypto market. As mentioned above, it is currently a bear market.

That means most people hesitate to keep these assets. Cryptocurrencies are speculative assets that are highly volatile. Meanwhile, the global economy is increasing its recession risk.

Most respond to such conditions by running to more secure assets and leaving riskier ones. As a result, many investors sold their cryptocurrencies to buy bonds and other perceived hedges.

What does that have to do with the NFT market? Non-fungible tokens record the ownership of physical and digital goods via blockchain or crypto networks.

In other words, NFTs rely on cryptos. If the latter crashes, so will non-fungible tokens. Moreover, the NFT market suffers from FOMO (fear of missing out).

Many investors pour money into projects that are trending. However, hype does not guarantee success. Most of the projects crash, leaving investors empty-handed.

Worse, NFT scams plague the market. People associated NFTs with digital art because of the success of Beeple. He sold his artwork as an NFT for $69 million.

The news made headlines, and many wanted to profit from NFTs. Eventually, people used the NFT market to sell artworks at ridiculous prices. As a result, NFTs gained a bad rap for shady practices.

Conclusion

NFTGo founder Tony Ling told CoinTelegraph that innovation would push the adoption of this technology forward. For example, Mastercard has launched NFT customized debit cards.

Payment apps Maya and GCash let Filipinos buy cryptos. Meanwhile, luxury brands are also entering the NFT market. For instance, Tiffany & Co sells custom NFTiff pendants.

Technological progress will continue to shape our world, and NFTs are part of those changes. Follow Inquirer Tech to keep up with the latest news and updates.