GCash Futurecast 2021: New features that are easier and more accessible for the everyday Filipino

![]()

Caption summarizing the event: The GCash Futurecast 2021 reveals the company’s future plans by unlocking possibilities and solutions to help make Filipinos’ lives better every day.

GCash is undeniably the Philippines’ #1 e-wallet platform, empowering and enabling over 38 million users to fulfill their goals with secure digital finance that has never been more accessible. With the aim to make Filipinos’ lives better every day, GCash introduced a brand-new line-up of services that will cater to every Filipinos’ needs through an online briefing called “GCash Futurecast” last May 12, 2021. The event was hosted by Bianca Gonzales-Intal, and was attended by different media partners and journalists.

Martha Sazon, President and CEO of GCash opening the event and introducing the line-up of services.

These new services are a response to the worries of the everyday Filipino, and a transformation to more than just an e-wallet platform; GCash now offers a variety of lifestyle and financial services that allows users to shop, save, invest, and secure an insurance coverage for them and their families – all in one app.

GCash believes that all Filipinos deserves to save, invest, and grow their money.

With the expansion of their services, GCash provides not only an easier and more accessible platform, but also an opportunity for more Filipinos to unlock a bigger and brighter financial future. GCash is committed to delivering on their promise, as they believe that finance should be available to all Filipinos.

The presenters of the GCash’s new line-up of services. (L-R First row: Frederic Levy, Maxine Pinpin, Winsley Bangit, Chito Maniago; L-R Second row: Jerome Lin, Fe Olivia Mir, Prabh Singh, JF Darre).

Unlocking A More Convenient Lifestyle

COVID-19 has caused a shift in everyone’s lifestyle habits, and GCash offers users a more efficient and convenient way of keeping up with their lifestyle through GLife.

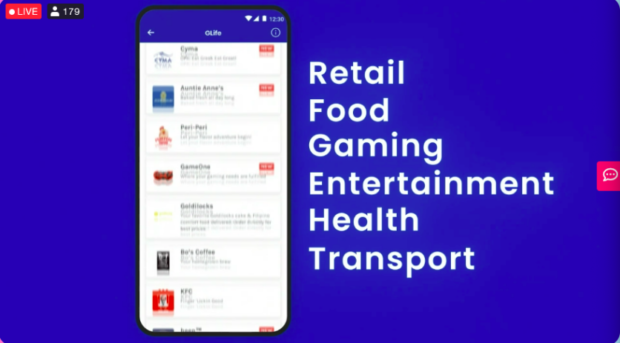

Introduced by Winsley Bangit, the Chief Customer Officer of GCash, the GLife feature gives users access to 35 different brands through the GCash app. With GLife, users can do their groceries and online shopping, as well as solve their food cravings with just one app. GCash has partnered with different brands such as Lazada, Puregold, Bo’s Coffee, KFC, McDonald’s, and Datablitz for this venture.

Prabh Singh, the GLife Head, summarizes the features of the lifestyle service with just one line: “Switch to pay time to play time with just a tap of a finger”.

Lifestyle has never been this accessible with GLife, offering services ranging from grocery shopping, to retail, down to even health and transport.

Unlocking More Platforms for Your Business

With the pandemic making everyone move to digital platforms, GCash has become everyone’s daily companion – from farmers and fishermen to sari-sari store owners and tech-savvy entrepreneurs. To empower every Filipino’s business thrive, GCash aims to deliver a more meaningful and seamless way of transacting through their app – the QR on Demand.

Introduced by Frederic Levy, the Chief Commercial Officer of GCash, QR on Demand is a better and safer way to send and receive money, removing the worry of “wrong sends”. Users can now generate their own QR codes in place of giving out their personal numbers for a secure and hassle-free payment method for personal or business use.

To serve OFWs, GCash plans to empower Filipinos abroad to take control of their finances and to provide them with accessible services through the GCash app. OFWs would only need a verified account to cash-in to their GCash accounts through remittance partners, and send those funds to their own or to another account.

With the GPadala Service still in development, GCash will soon enable OFWs with GCash accounts to send money directly to GCash and non-GCash users, as well as Philippine bank accounts to pay for their families’ bills.

Unlocking Safe and Secure Financial Possibilities

JF Darre, the Chief Data Officer and Head of GCash’s Financial Services, introduced a line-up of financial services easily accessible to all through the GCash app – Gsave, GInsure, GInvest and GCredit. These products were introduced together with Jerome Lin, the head of GSave and GInsure, and Maxine Pinpin, the head of GInvest.

For an easier way of managing money, GCash offers GSave – a fully digital and secure savings account that has no maintaining balances, fees, or initial deposits. This service is in partnership with CIMB Bank, and only requires one ID to open an account. GSave also offers a competitive interest rate of 4% per year.

Acquiring insurance shouldn’t be limited to those who can. With GInsure, GCash offers solutions that will protect families from breaking the bank in times of emergency. In partnership with Singlife, users will be able to procure an insurance plan that covers COVID-19 and Dengue for as low as P300. Consumers will be able to secure their lifestyles from any unforeseen event with GInsure.

Users will be able to fulfill their financial goals and start investing with GInvest. GInvest offers an affordable way to start investing in companies locally and globally, only requiring one ID, a minimum investment of P50 and a verified GCash account. Partnering with ATRAM, users will be able to choose from five (5) different funds with varying risks. Users will also be able to track their investments real time.

GCash also offers an alternative to high interest loans with GCredit, a digital credit line feature in the app. Users will be able to avail a set limit of money whenever they want, and a 3% interest rate. When the due is paid earlier, the interest rate will also be lower.

With these new features, consumers will be able to envision a brighter future ahead and manage their finances with just a tap of a finger.

Unlocking A Different Way of Bayanihan

Aligning itself with the UN Sustainability Goals, GCash aims to become one with the nation in the pursuit of making every Filipino financially literate, educated, and empowered. For GCash, no one gets left behind.

GCash has already made moves to foster sustainability and social responsibility, partnering with Local Government Units and NGOs such as the Philippine Red Cross, Save the Children, and UNICEF to name a few. They have also conducted campaigns in times of emergency, such as Tulong Taal, Fight COVID-19, Rolly PH Aid, Ulysses PH Aid, and Tulong Cagayan.

On the GCash app, there is a GForest platform where users are able to plant trees using the platform, and is an expression of modern-day digital bayanihan. The organization also wants to reach more Filipinos, understand their plights, and to implement solutions to their problems through Future-Ready Hackathons and programs like GCash for Good.

The different presenters and host taking a picture of their attendance that day, before taking questions from the media.

Ending the event, the President and CEO of GCash, Martha Sazon quoted a line from the popular movie “Hello Love, Goodbye”: “Ang choice, para lang yan sa mayaman”. For GCash, that should not be the case.

With GCash’s objective of making Filipinos’ lives better every day, their new services and features will surely achieve that, thanks to an easier and more intuitive application catered for all.

GCash’s Tagline for their Future Plans.