PH has most ‘e-cash adopters’ among 10 APAC countries during pandemic — study

MANILA, Philippines — The Philippines recorded the highest number of new “e-cash adopters” among 10 countries in the Asia Pacific during the COVID-19 pandemic, based on the latest study from global cybersecurity firm Kaspersky.

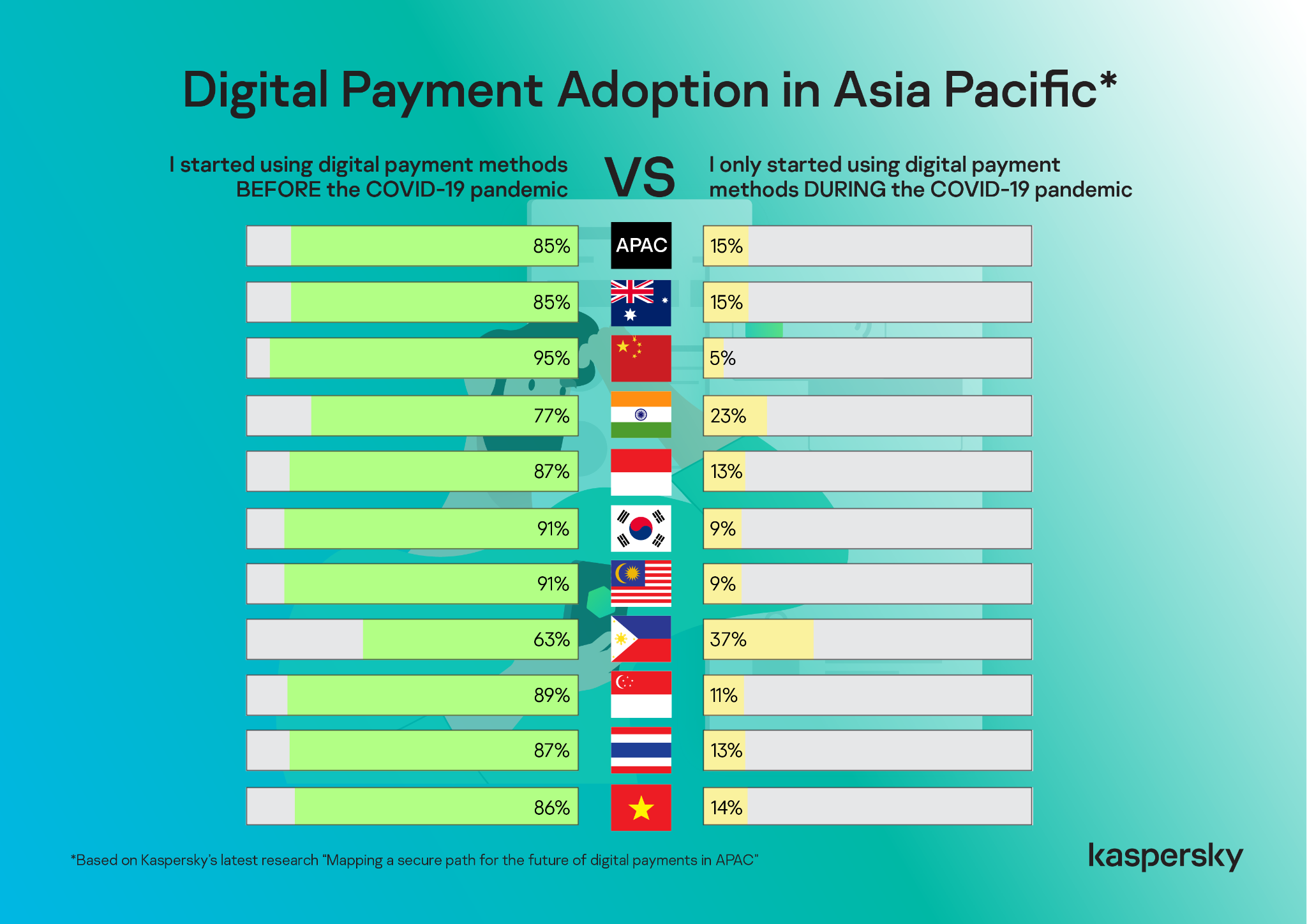

According to the Kaspersky report released on Thursday, 37 percent of respondents in the Philippines said they only started using digital payment methods during the pandemic, followed by India at 23 percent, Australia at 15 percent, Vietnam at 14 percent, Indonesia at 13 percent, and Thailand at 13 percent.

Meanwhile, the lowest number of first-time online payment users are China at five percent, and South Korea and Malaysia both at nine percent. Kaspersky noted that China has been a notable leader in mobile payments in APAC even before the pandemic.

Digital Payment Adoption in Asia Pacific (Data from Kaspersky)

The study, titled “Mapping a digitally secure path for the future of payments in APAC,” was conducted by research agency YouGov in key territories in the region, such as Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam.

Kaspersky said the survey responses were gathered in July this year with a total of 1,618 respondents surveyed across the said countries. The respondents are 18 to 65 years old working professionals who are digital payment users.

Meanwhile, the study also found that 90 percent of the Asian respondents has used mobile payment apps at least once in the past 12 months. Nearly 2 in 10, or 15 percent of them only started using these platforms after the pandemic started.

According to Kaspersky, safety and convenience triggered more users in the Asia Pacific to embrace financial technologies in making payments. More than half of the respondents said that they started using digital payment methods during the pandemic as it is safer and more convenient than physical transactions.

“Data from our fresh research showed that cash is still king, at least for now, in APAC with 70% of the respondents still using physical notes for their day-to-day transactions. However, mobile payment and mobile banking applications are not far behind with 58% and 52% users utilizing these platforms at least once a week up to more than once a day for their finance-related tasks,” said Chris Connell, Managing Director for Asia Pacific at Kaspersky.

“From these solid statistics, we can infer that the pandemic has triggered more people to dip their toes into the digital economy, which may fully dethrone cash use here in the next three to five years,” Connell added.

Kaspersky advised users of digital payment technologies in APAC to beware of fake communications related to electronic payments; use their own computer and internet connection when making payments online; not share their passwords, and; adopt a “holistic solution” of using security products and practical steps to minimize the risk of falling victim to online threats and to keep their financial information safe.

RELATED STORIES:

Filipinos urged to be on guard vs fraud when banking online

Bankers’ group warns public vs rising cyber crimes, fraud