Apple Card Offers High-Yield Savings Account

Your favorite gadget brand is turning into your trusted financial partner. Apple announced that it would offer high-yield savings accounts to Apple Card users.

The terms and conditions reveal a variable APR of 13.24% to 24.24%, depending on a cardholder’s creditworthiness.

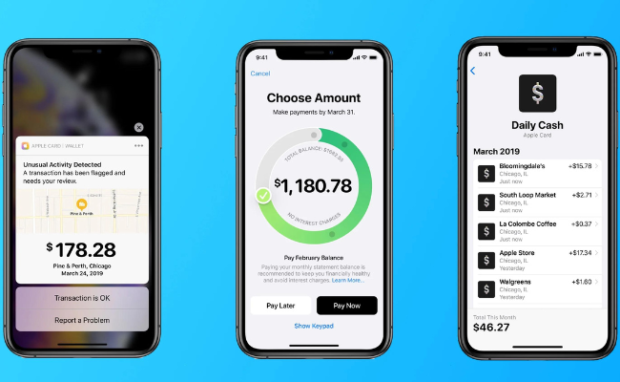

Apple Card users would be able to set up and manage Savings with the Wallet app. Moreover, it provides a new feature called Daily Cash.

What is Apple Card’s Daily Cash?

Photo Credit: 9to5mac.com

The Card provides a version of cashback called Daily Cash. It lets users receive 3% of payments to merchants like Apple, Nike, and Ace Hardware.

They gain 1% or 2% Daily Cash on other purchases. Moreover, there is no limit to the amount of Daily Cash they can earn. Jennifer Bailey, vice president of Apple Wallet and Apple Pay, shared details regarding Daily Cash.

Bailey said, “Savings enables Apple Card users to grow their Daily Cash rewards over time while also saving for the future.”

“Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives.”

How to apply for an Apple Card

Photo Credit: www.macrumors.com

You will need an Apple Card to earn Daily Cash. Fortunately, the application process is quick and easy. Begin by opening your Wallet app.

Tap the Add button, represented by a circle with a plus sign inside. Then, choose Apple Card, tap the Continue button, and follow the onscreen instructions.

Read the Apple Card Terms & Conditions carefully. Afterward, agree to its guidelines once you have understood and accepted them.

As mentioned, the app will offer an APR and credit limit, depending on your creditworthiness. Also, you could apply for a Card with your iPad.

First, open the Settings app. Next, scroll down and tap Wallet & Apple Pay. Tap the Add Card and the Apple Card options.

You may also enjoy this feature as a physical credit card, the titanium Apple Card. Begin by opening the Wallet app and tapping the Apple Card option.

Tap the More button that has a circle icon with three dots inside. Then, tap the Card Details button that looks like a circle with the letter “i” inside.

Scroll down and choose the Get a Titanium Apple Card. Next, follow the onscreen instructions and wait for the delivery details. You will receive the plastic card at your billing address.

Other Apple updates

Photo Credit: history-computer.com

The fruity techy company offered other products and services outside the Card. For example, it recently launched the iPhone 14 and Apple Watch Ultra.

Both feature satellite connectivity, automatically allowing them to request SOS without cell service. Moreover, it expanded its functions outside the Apple product ecosystem.

You may download and install the iCloud Photos app on your Windows PC. Also, you may open Apple Music on your Xbox video game console.

Conclusion

In the coming months, Apple will offer high-yield savings accounts for Apple Card users. They would offer a variable APY starting at 13.24%, depending on an applicant’s credit score.

At the time of writing, Apple had not specified when it would release the feature. Fortunately, that may give you time to build your credit score and gain the best terms and conditions.

You may read this credit score guide to see how you can get good credit. Also, you may read Inquirer Tech for the latest news and updates.