Businesses shift to digital payments in the post-pandemic era

The COVID-19 pandemic has brought about unprecedented changes across industries, and the way businesses handle transactions are no exception. As physical distancing and hygiene concerns continue to linger from 2020 through 2022, the adoption of digital payment methods skyrocketed. With a significant increase in demand for POS (point-of-sale) / payment terminals, e-wallets, and online payments, businesses are shifting their focus towards contactless and secure alternatives.

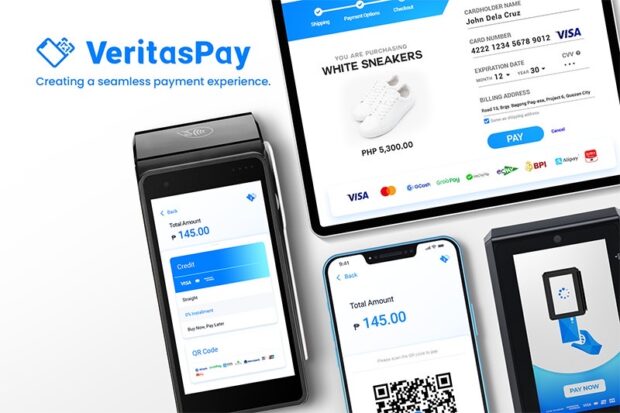

VeritasPay Philippines Inc., one of the local payment providers around, would know. They are in the industry, and have seen interest spike up among various businesses, as well as the competition within their field. With all that, and their ability to allow digital payment acceptance in different channels (POS, mobile, ecommerce), they’ve been busier than ever. In fact, the demand saw them gather a diverse set of merchants, from coffee shops, diners, grocery stores, clinics, and even specialty stores.

As things move forward, the remarkable transformation is more widespread than ever, which then generated a digital revolution in the global business landscape, and that includes what consumers expect in terms of available payment methods.

POS

In an effort to minimize physical contact, more and more businesses offered contactless payment solutions, mostly via POS. Payment terminals that support tap-and-go technology, such as near field communication (NFC) or QR code-based systems, have become increasingly popular.

Such terminals allow customers to make swift and secure payments without the need for physical contact or handling cash. With businesses actively embracing this technology, POS have become an essential component of the post-pandemic retail environment.

E-Wallets

E-wallets, or mobile/digital wallets offer a good deal of convenience as it enables users to store payment information securely on their mobile devices. By simply scanning a QR code or entering a recipient’s information, individuals can make seamless transactions.

The convenience, security, and speed offered by e-wallets have resonated with businesses and consumers alike. The post-pandemic world has witnessed an exponential rise in the adoption of e-wallets, with both small and large enterprises incorporating them as a preferred payment method. The flexibility and ease-of-use of e-wallets have played a crucial role in driving the shift.

Online Payments

With lockdowns and social distancing measures in place, businesses had to quickly adapt to digital platforms to sustain their operations. The change in normalcy led to a surge in e-commerce activities, with consumers increasingly relying on online channels for their purchases.

As such, businesses have invested heavily in enhancing their online payment infrastructure. Secure payment gateways and encrypted transactions have become the norm, instilling confidence in consumers to embrace digital payments.

Benefits and Implications

First, it provides a convenient and efficient way to conduct transactions, reducing queues, and streamlining the purchasing process. It also minimizes the reliance on physical cash, and thus, helping neutralize theft and fraud. Then there’s also the digital trail that simplifies record-keeping and accounting processes. Finally, customers can be gathered and help get insights into consumer behavior.

The shift has broader implications for the business landscape. As businesses adapt to meet consumer demands for contactless transactions, they will foster an environment of trust and safety, which is critical for recovery and growth. In turn, that also creates opportunities for companies, stimulating innovation and competition in the market.

The best business owners acknowledge that change is inevitable. Now that we are a few years into the digital revolution though, it seems like the change would’ve happened with or without the pandemic, as it was only a matter of time before businesses and consumers recognized what digital payment acceptance brings.

For more info on VeritasPay and its services, visit:

www.veritaspay.com www.facebook.com/veritaspay/

ADVT