Critical illnesses are more common than you think. Are you prepared for the costs?

We’ve built a habit of telling ourselves “It won’t happen to me!”, “I’m too young to need it!” or “I have a family history of good health!” to avoid facing any health-related uncertainties. However, the reality is that life can be unpredictable, and serious illnesses can affect anyone, regardless of age, health status, or family history. In fact, the Department of Health has noted that Filipinos are most prone to critical illnesses such as stroke, heart attack, and cancer.

With healthcare costs in the Philippines often being a significant burden, critical illness insurance serves as a vital safety net, protecting families from the financial strain of serious conditions. Many of these conditions are already familiar, but how likely will you or a loved one experience these in a lifetime? And how much do we know about the costs and the ways to ease the financial burdens that come with treating them?

- LUNG CANCER

While it is widely believed that lung cancer is mainly caused by smoking, statistics reveal that a significant number of non-smoking Filipinos—both male and female—are diagnosed with the disease. Secondhand smoke raises the risk of lung cancer by 20 to 30 percent, meaning that even if you don’t smoke, you’re still at risk if you’re around friends or family members who do.

As one of the leading causes of cancer-related deaths in the Philippines, Lung Cancer may cost over PHP 1 million to treat, with patients often facing medical care including chemotherapy, radiation, and surgery. Patients may also face significant out-of-pocket expenses due to limited HMO coverage and loss of income during treatment.

- STROKE

Although it’s common to think that a chance of a stroke only occurs later in a person’s life, research shows that stroke cases are increasing, particularly among younger populations, due to a rise in risk factors relating to high blood pressure and living sedentary lifestyles.

Immediate costs for treating a stroke including hospitalization, diagnostic tests, and emergency care can add up to an estimated PHP 1.8 million. After a stroke, the costs of surgery, intensive rehabilitation, ongoing therapy, medication, and potential long-term care can quickly add up, placing a significant financial burden on patients.

- ACUTE HEART ATTACK

When blood flow to the heart is obstructed, it can damage the heart muscles and result in an acute heart attack. Each year, around 300,000 Filipinos suffer from a heart attack, with contributing risk factors including hypertension, diabetes, smoking, and high cholesterol.

Immediate costs often include emergency medical services, which can range from ambulance fees to hospital admission and intensive care unit (ICU) stays. Overall, the average cost of treating an acute heart attack in the Philippines is PHP 1 million. Post-care can lead to significant expenses from diagnostic tests, ongoing medication for heart health, and investments in healthier lifestyle changes, all of which can strain finances.

- BREAST CANCER

While breast cancer can affect women of any age, there has been an increase in cases from the age of 30. This poses a major public health issue, with more cases diagnosed each year. Adding to the challenge, around 70% of breast cancer patients in the Philippines come from low-income backgrounds.

Initial treatment costs can be high, averaging PHP 450,000 for surgeries, chemotherapy, and radiation, and often leading to unforeseen expenses from frequent hospital visits. Following treatment, patients may encounter additional costs for follow-up appointments, diagnostic tests, and long-term medications.

You’re insured with GInsure

Many affected individuals face unexpected costs from inadequate funds and healthcare coverage, leading to financial hardship that may hinder necessary follow-up care. Additionally, treatment-related income loss and lack of insurance can take an emotional toll on patients and their loved ones.

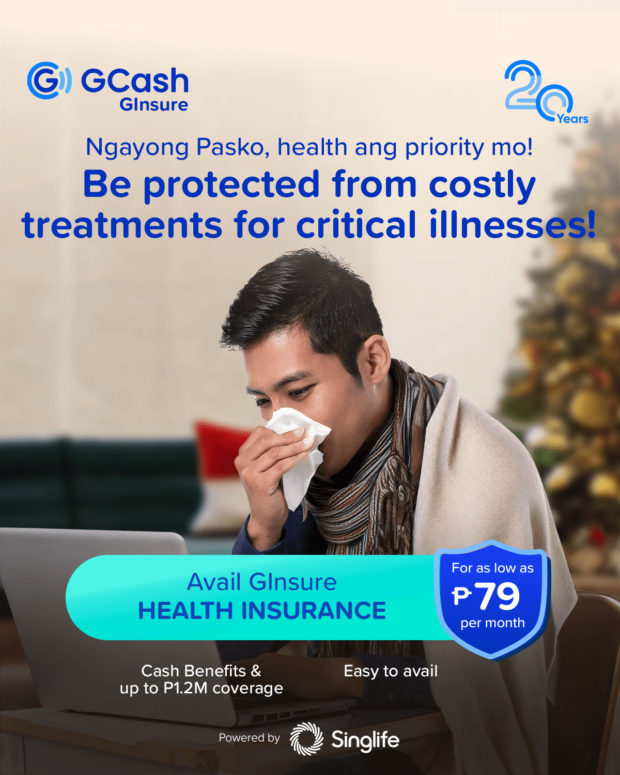

GCash, through GInsure, has partnered with trusted insurance companies to provide protection against critical illnesses. Singlife’s 100-in-1 Medical Plan provides a valuable safety net to protect yourself against unexpected medical expenses when dealing with critical illnesses, including the most prevalent conditions that can arise unexpectedly.

You have the liberty of choosing your insurance coverage package based on your needs and if you get diagnosed with any of the critical illnesses, you can avail up to PHP 500,000 to pay for medical bills, starting as low as PHP 100 a month. Depending on your package, you can receive either a cash benefit if you or any of your dependents are diagnosed with a minor or major critical condition, or a lump sum payment in case of accidental disability or death.

GInsure ensures that users have access to comprehensive insurance in a single, easy-to-use app. The Singlife 100-in-1 Medical Plan can easily be purchased through the GCash app without needing a medical exam. Just select GInsure, tap on Health, and choose the plan that suits your needs. Fill out the required information needed, and get a quotation from your chosen package. You can then confirm your purchase and pay the premium payment using your GCash account.

By making critical illness insurance accessible and manageable, GInsure empowers individuals to take control of their health and financial well-being, allowing them to focus on what truly matters—recovery and quality of life, without the added stress of overwhelming medical costs. You may not be able to predict the illnesses you could get, but GInsure makes sure you’re prepared for any health-related situation.

Of the 100+ critical illnesses that GInsure can cover, this article only discussed 5. To read more about the terms of Singlife 100-in-1 Medical Plan, head over to https://new.gcash.com/services/ginsure

Users may access GInsure on the GCash dashboard or find it under “Grow.” No GCash yet? Download the GCash App on the Apple App Store, Google Play Store, or Huawei App Gallery. Kaya mo, i-GCash mo!

ADVT.

This article is brought to you by GCash.

Read more stories here:

Office supply increase leads to rising vacancies, lower rents

Infinix HOT 50 Pro+ Series: Can the world’s slimmest gaming phone really handle it all?

Empowering Filipino businesses: PayMongo launches Soundbox to elevate in-store payment solutions