Over P200M lost to ATM thieves in 2013—BSP

MANILA, Philippines—Authorities on Wednesday bared during a Senate hearing the different modus operandi being used by criminals to steal information from automated teller machine (ATM) cards that resulted to over P200 million stolen deposits last year.

In 2013 alone, the Bangko Sentral ng Pilipinas (BSP) recorded 1,272 reports of ATM fraud involving an estimated P220 million lost to the scam, Vicente de Villa III, director of BSP’s Supervisor Data Center, said during a joint hearing of the committees on public order, banks , and trade.

De Villa said the amount lost last year was higher than the P175 million in 2012.

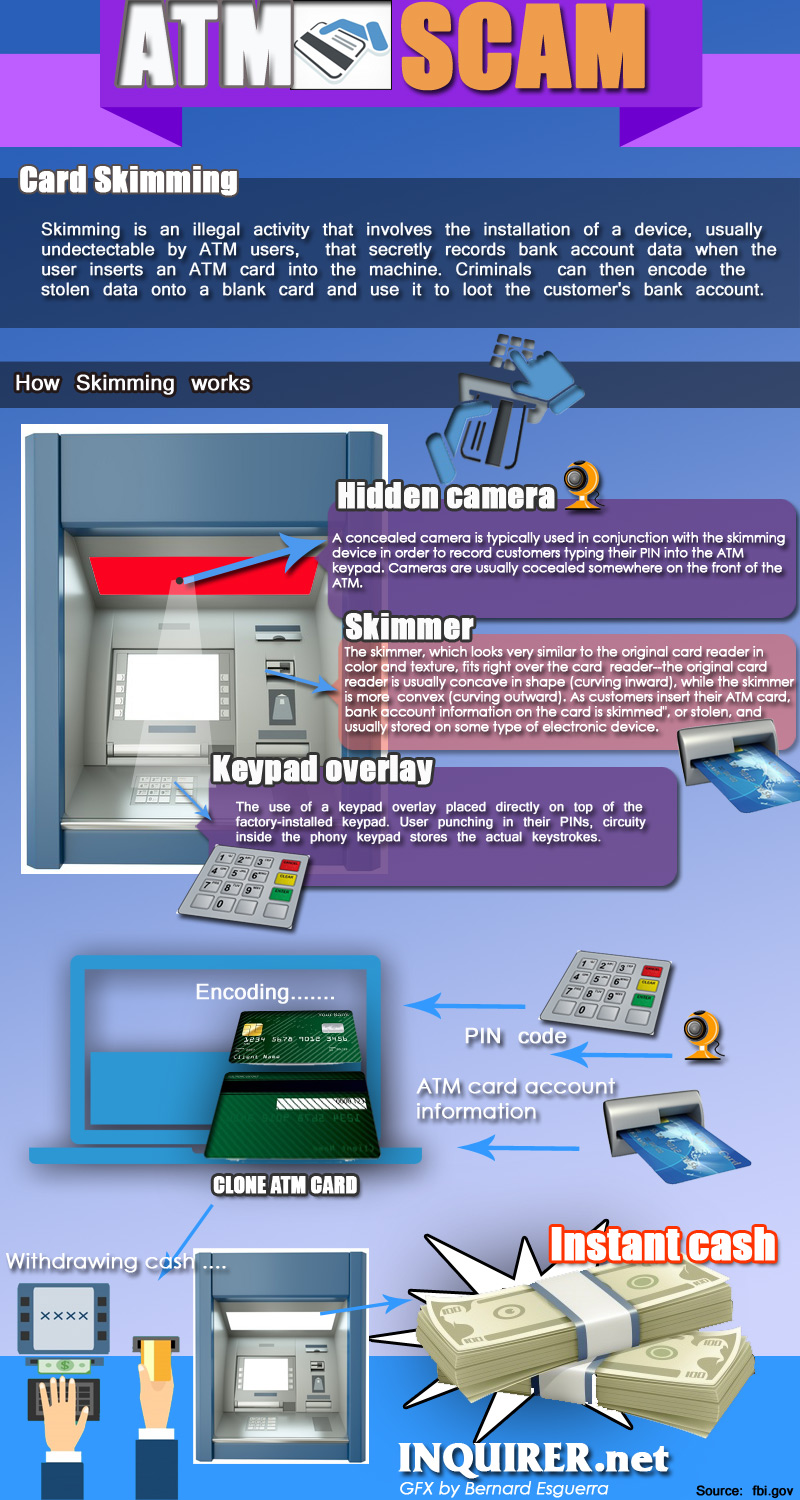

The common modus operandi now being used by perpetrators was through the use of a “skimming plate, ” which is placed on top of keypads to copy the personal identification number (PIN) of depositors, authorities said during the hearing.

“Ito na ho yung common, hindi mo na kailangan yung camera (This is now the common strategy, the camera is no longer needed),” one official told the committees.

“The devices used are smaller than a deck of cards and are often fastened in close proximity to, or over the top of the ATM’s factory-installed card,” read the power point presentation presented by the police during the hearing.

The presentation showed several pictures to identify the normal ATM machines from tampered ones.

In the normal ATM machine, the flashing card entry indicator could be seen easily while in the tampered machines, no flashing card entry could be seen and the “shape of the snout is different.”

“Most skimming devices will obscure the flashing card entry indicator,” de Villa said in his presentation.

He flashed a photo showing a “PIN capturing device” fitted to the of the ATM and a brochure holder with a pin-hole camera placed on the side of the ATM frontage wall used to capture images of the keypad and customers inputting their PIN.

Authorities said skimming devices are normally attached to ATMs during quiet — either early morning or late evening.

Some criminals, they said, are also selling bank, ATM, and credit card information online.

“So the anti-cybercrime group is also monitoring online activity,” a police official said during the hearing.

To address this problem, the BSP has issued a directive requiring all banks to shift from a magnetic stripe to an EMV (Euro Master Card Visa).

Unlike the magnetic stripe which contains permanent information that can be copied easily, the EMV card is said to be “more dynamic” making it more difficult to steal information.

RELATED STORIES

NBI working with bank officials to identify gang behind ATM scam