Is There a Better Way to Transfer Money?

SEATTLE, Washington – Picture a money transfer company with a glowing yellow sign above a dingy  storefront in a strip mall. Now imagine trusting them to send hundreds of dollars of your hard-earned money to your family and friends back home. Picture the company charging you hidden fees or making mistakes in your transfer because they rely on outdated paperwork to conduct the transaction. All with limited customer service to help you along the way.

storefront in a strip mall. Now imagine trusting them to send hundreds of dollars of your hard-earned money to your family and friends back home. Picture the company charging you hidden fees or making mistakes in your transfer because they rely on outdated paperwork to conduct the transaction. All with limited customer service to help you along the way.

This is today’s international money transfer industry, but not for long. One technology company, Remitly, recognized it can dramatically improve how people send money overseas by keeping them away from that storefront, instead using the smartphones in people’s pockets.

Remitly started its business several years ago by developing a mobile app and building a fast, secure transactions network. Remitly first offered its service to people sending money from United States to the Philippines. Since its launch, the number of people using Remitly’s money transfer service has multiplied. The company recently processed its one-millionth transaction.

Even with that growth, the company has maintained standing among the industry’s highest-rated mobile apps and highest customer satisfaction ratings. Remitly did this by “always putting our customers first,” according to Matt Oppenheimer, co-founder and CEO of Remitly.

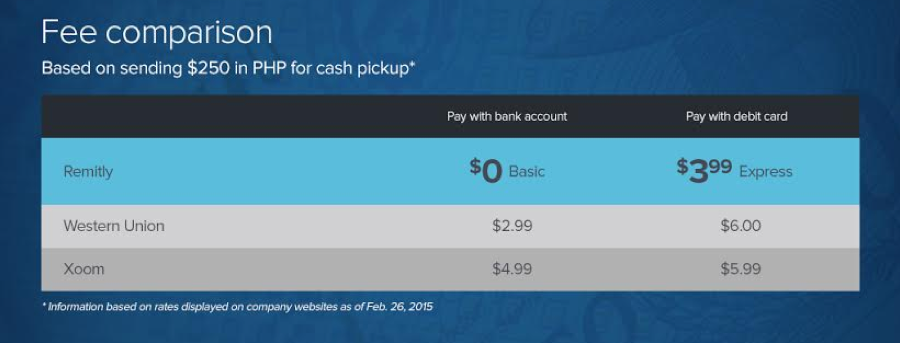

Remitly has grown because it uses extremely efficient technology that enables it to charge only a small fraction in fees – compared to fees charged by more traditional options. In fact, it offers pricing to its Filipino customers ranging from free to $3.99, depending on timing of transfer, which compares to up to $6.00 or more in fees charged by Remitly’s competitors:

According to the company, however, offering a service that is more affordable than other options isn’t enough.

Remitly has invested heavily in three areas to make sure it was giving customers the best experience possible when transferring money: it developed the easiest app, it built a 24/7 customer service team, and it built a fast, secure network for transactions. These collective investments allow the company to add an innovative messaging and notification service between customers in the app, instant access to local customer support by phone or email, nearly 11,000 cash pick-up locations in the Philippines, and real-time delivery commitments with updates for every transaction.

The company’s strategy to combine an extremely affordable remittance service with the best customer service has led Sonny R., a Remitly customer, to say Remitly has “much better customer service than any other online remittance company. [It has] better rates, [is] very easy to register, [and is] much faster when delivering the funds to my account.”

According to Oppenheimer, “We’re motivated by different measures than traditional businesses in our category. Our whole mission is to deliver on our promises to customers, so they can deliver on their promises to loved ones back home. And we’re just getting started.” (Remitly supplied this video that details Oppenheimer’s story and what motivates the company to continue its expansion.)

If Remitly keeps its current course, fewer and fewer of you will have to endure a trip to the dingy storefront in a stripmall to send your money overseas. ADVT