Privacy assured as telco complies with Credit Info Systems Act

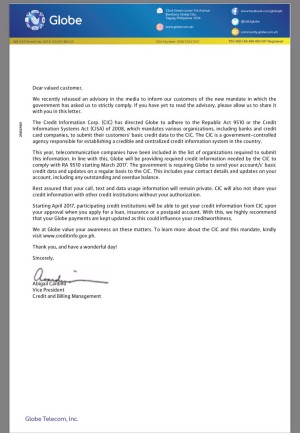

Globe Telecom told subscribers it started submitting this month customers’ “basic credit data” to the Credit Information Corp., while ensuring all their communications and internet usage activities would remain protected and private.

The government-controlled CIC was established in line with the Credit Information Systems Act, paving the way for a reliable and centralized credit information system to track the record of borrowers.

Once limited to financial institutions such as banks, insurance companies and credit card companies, the CIC had said it would include telecommunications companies among those entities covered by the law.

“In line with this, Globe will be providing required credit information needed by the CIC to comply with RA [ Republic Act] 9510 starting March 2017,” Globe said in an advisory to subscribers.

Globe said it started submitting basic credit data updates to the CIC, and will continue to do so on a regular basis. This would include contact details, and updates on a user’s account, such as outstanding and overdue payments.

“Only contact and credit information details [will be shared],” Yoly Crisanto, head of corporate communications at Globe, said in a text message. “We don’t have banking details of our customers and we are also not being required to share banking details.”

The law’s implementing rules defined basic credit data as both positive and negative credit information, and all details that relate to a borrower’s credit worthiness.

According to the CIC, negative credit information could involve adverse court judgments relating to debt and reports on bankruptcy, insolvency, and corporate rehabilitation. Positive credit information could refer to timely payments, repayments and non-delinquency.

“Rest assured that your call, text and data usage information will remain private,” Globe added in its letter to subscribers. “CIC will also not share your credit information with other credit institutions without your authorization.”

“Starting April 2017, participating credit institutions will be able to get your credit information from CIC upon your approval when you apply for a loan, insurance or a postpaid account,” Globe told subscribers.

Among the law’s objectives: bolster overall credit availability, mainly to micro, small and medium-scale enterprises; make credit more cost-effective; and reduce the “excessive dependence” on collateral to secure credit facilities. JE