AsiaPay PH: Igniting Ecommerce through Online Payments

MANILA, Philippines – The Philippines is no stranger to e-commerce. Thanks to the growing popularity of online retail and deal sites such as Bench, Stores Specialists Inc., Ensogo and Groupon, online shopping has become a thriving industry nationwide. With the success of these companies making its way to both mainstream and online media, other businesses began to follow suit.

Statistics from Internet World Stats show that the Philippines has over 44.2 million internet users in the country as of June, 2014. Improved access to internet broadband services, extensive smartphone penetration, and widespread use of social media were some of the catalysts for this growth. Furthermore, a recent study from We Are Social states that each Filipino spends an average of 6.2 hours per day online through either a desktop or laptop and 2.8 hours logged to the Internet through a mobile device.

AsiaPay Philippines’ Senior Manager for Sales and Marketing, Mr. Mau San Andres, believes that this developing state of e-commerce in the country presents a very lucrative market for businesses of all sizes.

A Shift from Offline to Online

The e-commerce landscape offers countless opportunities for startups, SMEs and large enterprises. By extending a merchant’s presence online, reaching untapped consumer markets become a thing of the past. In addition, operating an online storefront significantly costs less than running a brick-and-mortar store.

Unlike a traditional retail outlet, an e-commerce website is open 24/7 thereby allowing consumers to make transactions anywhere and anytime as long as they have an internet connection. This means that by going online, merchants can accept orders and payments all-day. According to a recent survey made by ThoughtBuzz, the purchasing decisions made by Filipinos are highly influenced by online reviews. Hence, establishing an online presence is now a ‘must-do’ for businesses.

“The rise in online shopping activity has turned e-commerce into a virtual gold mine for local businesses. Today, we’re seeing more and more Filipinos make transactions online across different channels,” says Mr. San Andres. “Being online is no longer a ‘nice-to-have’. In this digital age, it’s a ‘need-to-have’ component of any tailored business strategy,” Mr. San Andres adds.

The Catalyst for Success

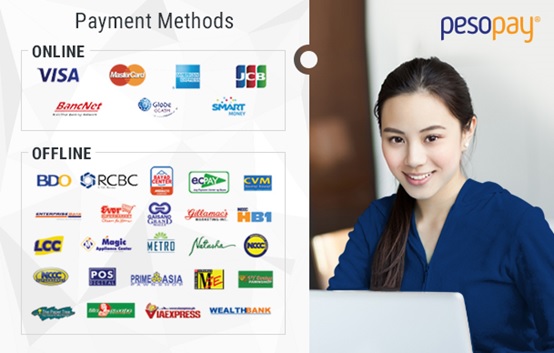

Aside from the importance of logistics and laws that govern internet transactions, payment providers also play a key role in the rapid adoption e-commerce in our country. Since the Philippines is predominantly a cash-centric society, alternative payment methods such as debit cards, bank deposits, e-wallets and cash on delivery were utilized in order to solve the differences in payment preferences across consumer segments. The increased availability and variety of payment methods in our country has empowered consumers to engage in e-commerce transactions.

As the leading online payment service provider in the country, AsiaPay Philippines continues research, develop and serve electronic payment services that make it easier for businesses to make the digital leap. “By providing end-customers more choices to pay conveniently, merchants will experience increased sales conversions and reduced shopping cart abandonment rates,” says Mr. San Andres.

“Serving multiple payment methods is no longer just an option for merchants. The key to staying relevant with your target market is to keep up with the changing needs of consumers,” Mr. San Andres points out. Offering the right mix of payment options at checkout has indeed become a key differentiator for brands. As shopping behaviors continue to evolve, the capability to adapt to these changes is now an integral part to their success.

Shaping the Future of E-commerce

In order to influence both local businesses and consumers to build confidence in participating in the e-commerce space, AsiaPay PH has specifically designed a payment gateway for the Philippine e-commerce market. Designated as PesoPay, this end-to-end payment solution aims to be the de facto standard in online payments.

“Enhancing merchant-consumer relationships through secure online payments has always been our mantra since day 1. By arming merchants with a complete suite of payment services, we firmly believe that this will stir up e-commerce adoption in the country by enabling more consumers to finally purchase products and services online without being limited with the payment options available at checkout,” says Mr. San Andres.

To learn more about AsiaPay Philippines and PesoPay, visit www.pesopay.com. ADVT